It is evident that Cypriots are lagging in Financial Literacy. The COVID-19 pandemic has aroused intense business interest in workforce resilience in a way we have never seen before, in Cyprus and abroad. According to recent research made by Pulse Market Research for AON Cyprus, there are distinct gaps in Financial Literacy.

At the level of knowledge, 51% of respondents have a low Financial Literacy, which is more pronounced in the younger age groups and in the lower income groups. Higher Financial Literacy is associated with more comfort in investment decisions, with only 29% stating that they cannot make their own investment decisions.

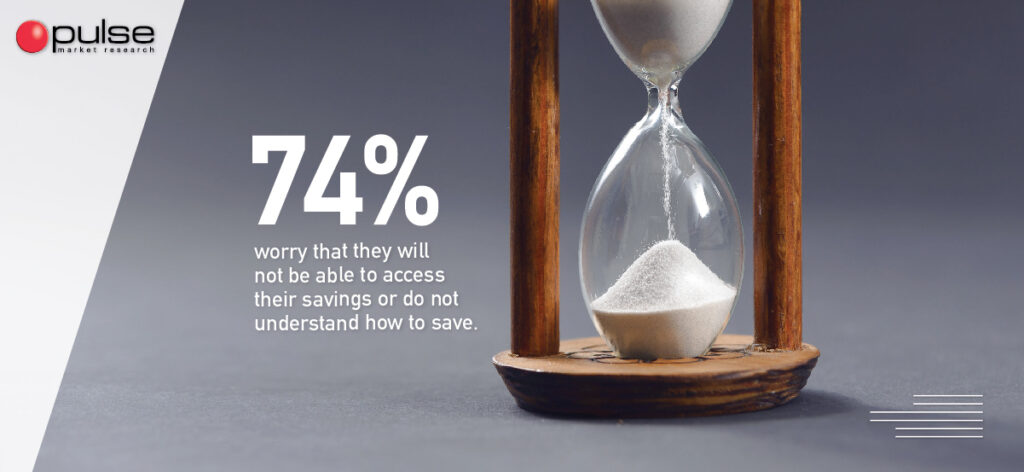

The most common financial concern is saving for the future, while the priorities for saving are the creation of an emergency fund and retirement income. Disappointing, however, is the fact that 60% of respondents have not yet started saving for their retirement, as well as 42% who consider it impossible to retire at the age they want.

The majority of respondents said they need savings guidance for long-term goals, such as retirement. Financial Literacy is a vital foundation for people’s future well-being, helping them manage their finances, teaching them about risks and ultimately, looking to upgrade their financial well-being.

Financial Literacy, quite simply, is a prerequisite for economic freedom.